-

vSaaS Global > Case Studies > Avalara Integration – Case Study

Avalara Integration – Case Study

Client

Our customer specializes in providing custom direct mail, print and digital marketing solutions for Real Estate Brokers and Agents. They are part of a billion dollar conglomerate specializing in personalized designed and branded short-run products and services. The unique feature of their products and services are that they are easy to use yet also meet the personalization and customization needs demanded by their successful clientele who are focused on getting leads, closing listings and keeping clients for life.

Objective

The project was for creating an ecommerce storefront that would enable the group companies to cross sell and upsell their products to their customer base. Off-the-shelf ecommerce products were not suitable because of the level of customization required at every level such as group company, product category and agent office.

Challenges

The site had to support a product 63000 product categories. Also, some of the product could be bundled and sold, in which case the category would again change. Further, there are over 12,000 taxing jurisdictions throughout the US and an order could comprise of products sourced from different vendors with different jurisdictions. Add to this 100,000+ rules, rates, and boundary changes annually, which is tedious work in terms of compliance and tracking. The challenge was to provide a seamless solution to address these challenges

without manual effort

Solution

In order to find a reliable solution for the tax related challenges, Congruent recommended to use the leading cloud based tax compliance solution Avalara AvaTax™ which in real-time calculates the Judiciary, State & County Taxes at the time

of cart checkout. As each Product in the site had a unique tax code and could be fulfilled at different

vendor places, we created Avalara transaction for each vendor group in the cart and each transaction could accommodate multiple product types in it. AvaTax API’s transactions were classified into SalesInvoice and SalesOrder.

SalesOrder : While creating SalesOrder, temporary transaction will get generated and

used to get the tax estimates.

SalesInvoice: While creating SalesInvoice, permanent transaction will get generated

and can be used for Tax Filing.

For each transaction, following details were submitted to Avalara:

Unique Order Id

Valid Ship From Address

Valid Ship To Address

Order total

Shipping Amount

Handling Amount

Discount Amount (If Applicable)

Since the From and To Addresses play a critical part in tax computation, they were validated using UPS (United Parcel Service) integration and end user had the ability to correct incorrect address during the checkout.

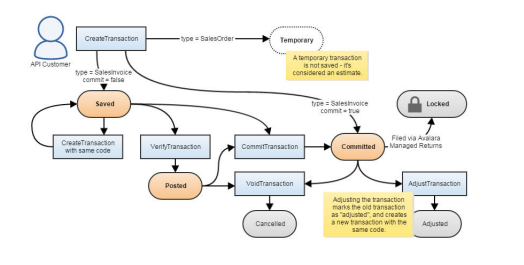

Life Cycle

Our solution also included a reconciliation process to handle subsequent order adjustments, cancellations and returns. Thus, any Avalara transaction could be modified in the following ways:

- Adjust: To keep a transaction intact, but make a change or correction, you would adjust the transaction using the AdjustTransaction API.

- Void: To remove a transaction that is not valid, adjust the transaction using the VoidTransaction API

- Refund: creating a ReturnInvoice with negative values. These negative values indicate that money is being returned from the seller to the purchaser

- If End-user requests alter/ delete the order to customer support, we have developed an Administrator tool that will use order Id and uses the above reconciliation process to calculate taxes precisely.

- For the quantity changes to product(s) or for removing a product in an existing order, use a combination of Void and Create transaction.

- For Order cancellation, use a combination of Void and Refund transaction.

Benefits

- The integration with Tax SaaS solution is designed in such a way that updates become effective as soon as they’re deployed, keeping the calculations correct, accurate and compliant at the same time.

- As the address details are the key for calculations, we designed a solution to update the tax calculations automatically whenever there is a change to address.

- To ensure delivery point verification and validate the vendor and shipping address for accurate tax calculations, we also included integrated with UPS.

- The solution is designed to be completely fail safe and fault tolerant, capable of handling huge order volumes with almost no human oversight required to run and monitor the process.

Technology Used

AvaTax v2 SDK, MYSQL, MongoDB, ExpressJS, Angular, NodeJS